analysis

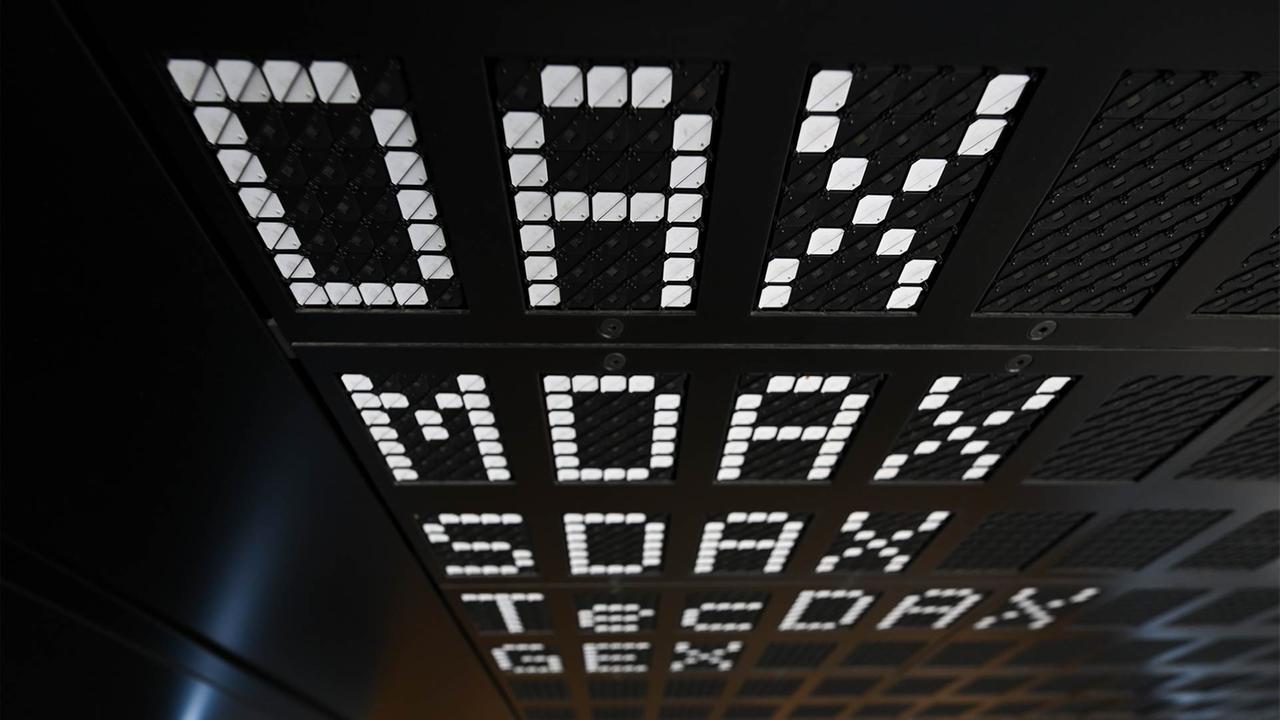

The German leading index DAX is rushing from record to record. Not so the “second row”: The MDAX is clearly lagging behind this year. Does this show the weakness of the German economy?

There is no shortage of big names in the second series of German stock exchanges: the 50 companies listed in the MDAX include the airport operator Fraport and Deutsche Lufthansa, the sporting goods manufacturer Puma and the steel group Thyssenkrupp. However, awareness alone does not ensure success on the stock market. Small caps – i.e. smaller and medium-sized companies – cannot currently keep up with the heavyweights on the stock market.

Since the beginning of the year, the DAX has increased by around twelve percent, while the MDAX is standing still. Thomas Altmann, portfolio manager at QC Partners, points out that the largest corporations primarily earn their money abroad: “The German companies from the DAX in particular only make a comparatively small part of their sales – most recently 18 percent – in Germany, while these Parts of the small cap indices will be significantly higher.”

Weak economy puts a strain on smaller ones Stock exchange companies

Analysts put the share that the MDAX companies sell in Germany at around a third. This means that the weakness of the German economy is becoming more clearly visible among medium-sized and smaller listed companies, says Joachim Schallmayer, capital market strategist at Deka Bank.

The German economy has been particularly hard hit by the world crises, such as the war in Ukraine and the increased energy costs: “And ultimately, Germany is the red light when it comes to economic growth in Europe – unfortunately. And of course that also shines through the MDAX companies,” said Schallmayer.

Falling interest rates could provide an upswing

In addition, according to the Deka expert, the somewhat smaller listed companies have suffered particularly from increased interest rates and poorer financing conditions. Conversely, you could also benefit particularly if the European Central Bank actually starts cutting interest rates in June.

The mood has passed the low point: “You will see that the MDAX companies are coping well in a difficult environment and have now bottomed out. This is shown, for example, by the purchasing manager indices,” says Schallmayer.

Small cap indices further behind record marks

However, the gap between the indices is still drifting further and further apart. This is also expressed in numbers: the DAX has just reached a record high again. It is well over 18,000 points.

The situation is different for small caps: MDAX and SDAX, the indices of smaller companies, are far away from their previous records. They are from 2021. At that time, the German small cap indices were considered particularly strong – the returns were in some cases significantly higher than in the DAX.

Small caps back to their former strength?

Can second-tier companies close the gap again? Deka analyst Schallmayer is confident. Solid profit prospects, a stable global economy and the soon-to-be-falling interest rates could help: “In combination, it is something that, in terms of the general conditions, suggests that the large valuation discount that the MDAX companies currently have can be gradually reduced can catch up little by little.”

It remains to be seen whether, when and how quickly the small cap indices will actually return to their former strength. It will probably take a while to reach the records recently set by the DAX. The MDAX is more than 25 percent away from its previous all-time high.

Sebastian Schreiber, HR, tagesschau, May 13, 2024 3:08 p.m