Ford's European location wants to cut one in four jobs in Cologne. According to experts, the electromobility transition came too late at the plant. They are calling for a European battery value chain.

With sirens wailing loudly, with rattles and horns, around 100 men and women run into the huge Ford hall, where the company meeting is about to take place. They are employees from production. They normally make Ford's new electric model, the Explorer, a high-priced SUV.

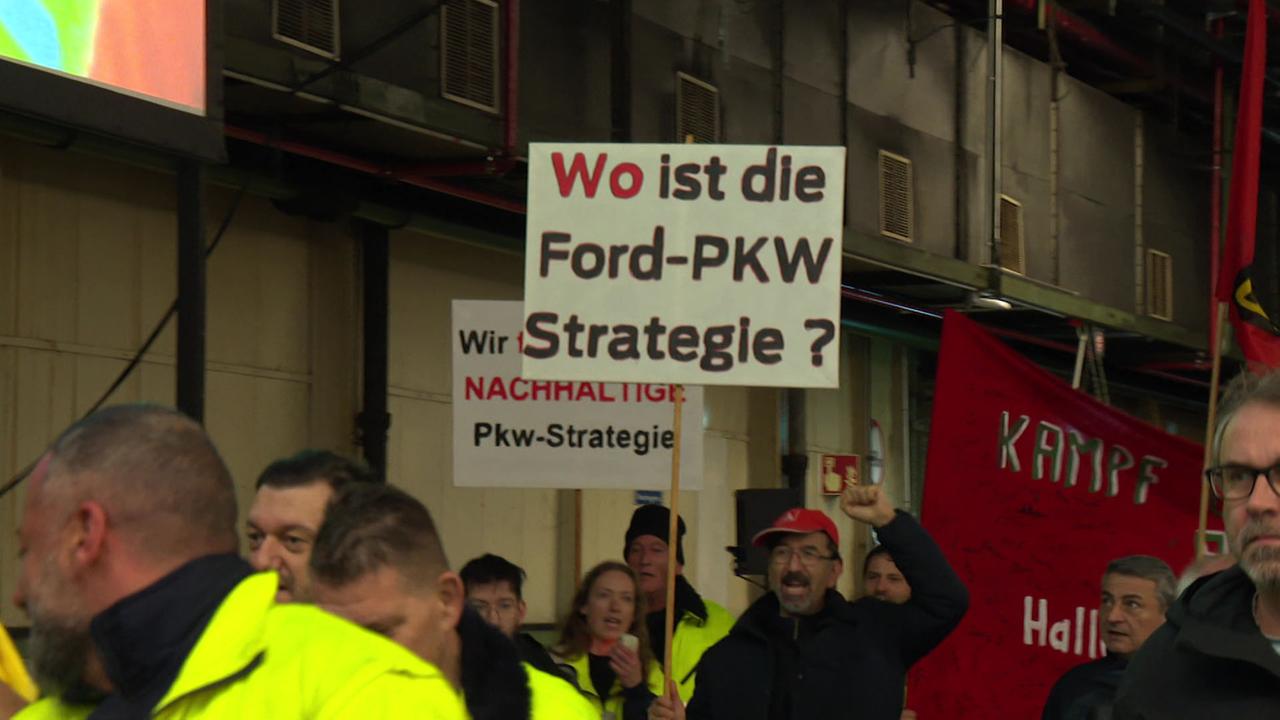

Today they carry posters that say: “Where is the car strategy?” One in four jobs at Ford in Cologne will be eliminated. They blame management for this.

Ford electric car hardly in demand

“We do our work properly,” says Hüseyin Kirac with conviction. The 35-year-old has been at Ford for ten years and has worked his way up to permanent employment through temporary work and training. He assembles the battery for the Explorer, which Ford buys from its competitor VW.

But there is hardly any demand for the car that he builds every day. Hundreds of copies are in Ford's own parking lots in Cologne, and Kirac is on short-time work. The father of two says he hasn't been sleeping well for days. “We used to build 2,000 Fiestas a day. Now we're at about 600 cars a day, and the numbers will probably go down even further.”

Market already saturated

Ford Europe actually wanted to reinvent itself. The factory in Cologne, where cars with combustion engines were produced for decades, became an “Electric Vehicle Center”; Chancellor Olaf Scholz, SPD, was present at the opening. Ford has invested several billion euros in the development of two electric car models.

It wasn't until June that the first all-electric Explorer rolled off the assembly line, intended for the European market. Too late, says Helena Wisbert, a professor at the Ostfalia University in Wolfsburg who researches the automotive industry. “With its electric mobility offensive, Ford is hitting a market that is already very full of supply and where demand is at the same time very subdued,” says Wisbert.

The previous regular Ford customers were used to cheaper compact and small cars, such as the Ford Fiesta. These people would not feel appealed to by the new, high-priced electric SUV. At the same time, the environmental bonus for electric cars will no longer apply at the end of 2023. This means that overall demand for electric cars in Germany has fallen sharply.

German electric cars restricted competitive

From the automotive industry expert's point of view, Ford as well as other German automobile manufacturers, for example VW, have, in addition to high personnel costs, a massive competitive disadvantage: They do not build their own batteries and only got into battery development late.

The USA or China are different. There has been a massive electromobility offensive by the Chinese government in China since 2005; among other things, battery production facilities have been set up there, supported by the state. According to Wisbert, Chinese car manufacturers are benefiting greatly from this today.

“Chinese companies now have 100 percent control over the large battery costs and can produce them in large quantities. This leads to economies of scale, i.e. cost advantages, which they can pass on to customers,” says Wisbert.

European Value chain

In Germany, on the other hand, research subsidies have disappeared. In order to keep up with competitors in the USA and China, it is important to now build a European value chain for electric car batteries, says Wisbert.

Uta Schröter, who has been working as a development engineer at Ford in Cologne for 26 years, is also hoping for this. But after the works meeting, in which 8,000 Ford employees took part, she is pessimistic. “The management has presented no strategy, no goals, no plans. Right now it looks to me as if there is no strategy at all. And that's what scares and worries me,” says Schröter.

There is no further information from Ford itself about the job cuts plans today. IG Metall spokesman David Lüdtke, on the other hand, speaks of the location being dismantled. If Ford were to implement its plan in Cologne, it would mean “dying in installments” for the workforce.