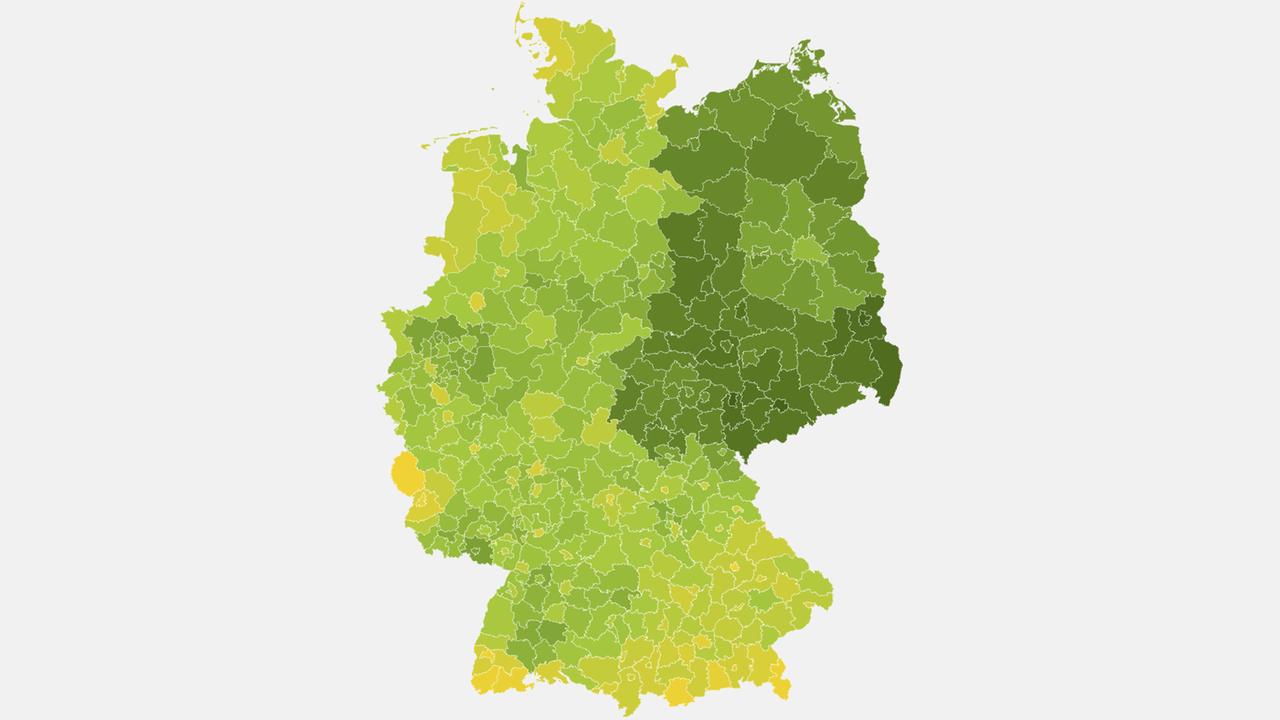

A study examined where people in Germany can afford the most from their statutory pension – i.e. where their purchasing power is particularly high. The result shows a clear regional pattern.

According to a new study, pensioners in eastern Germany are financially better off than in the west. An evaluation by the Prognos Institute, which was published today, shows that the ratio of rental costs to income from the statutory pension was particularly favorable in Gera in 2021. In contrast, regional pension purchasing power was lowest in western Germany and in the south, especially in Bavaria. The study was carried out on behalf of the General Association of the German Insurance Industry (GDV).

The economists related estimated regional rents and the average level of pensions for the 400 districts and independent cities in Germany for the years 2013 to 2021 and used this to calculate the local purchasing power. “The result is clear. Pensioners live particularly cheaply in East Germany,” write the authors. “Because relatively high pensions meet low living costs.”

Pension purchasing power an average of 1,036 euros

For the study, the authors used figures from the pension insurance research data center, which published the evaluation of the amount of pensions at district level for 2021 last fall. Prognos also used data on the asking rents in the relevant years for its calculations – as an indicator of the cost of living. Since 2021, both the cost of living and pensions have risen nationwide due to high inflation.

In Gera in 2021, the average monthly pension purchasing power was 1,437 euros, significantly above the national average of 1,036 euros. Gera is followed by four other East German municipalities in the top five: Chemnitz, Cottbus, Görlitz and the Spree-Neiße district.

Which municipalities are the most expensive?

“In Bavaria the situation is reversed,” says the study. “Purchasing power for pensions is well below average.” According to the authors, the generally above-average cost of living in Bavaria is not compensated for by above-average pension income.

According to the Prognos calculation, three of the five municipalities with the lowest pension purchasing power in 2021 were in the Free State: the districts of Berchtesgadener Land and Garmisch-Partenkirchen as well as Regensburg, each with 862 euros per month.

According to the study, the relationship between housing costs and pension levels was most unfavorable nationwide not in a Bavarian municipality, but in the Eifel district of Bitburg-Prüm in Rhineland-Palatinate. The study authors put the monthly pension purchasing power there for 2021 at 856 euros. The list of the most unfavorable municipalities for pensioners is completed by Freiburg im Breisgau in Baden, also with 862 euros per month.

No substitute for “well-founded individual case consideration”

However, the authors themselves limit the significance of their study and point out that only the benefits from the statutory pension insurance were taken into account in the calculation. Other income – for example from company and private pension insurance or from home ownership or share ownership – was not taken into account. A possible relief effect for pensioners who live in their own condominium and therefore pay no rent at all was also not taken into account.

The study thus provides “general information on potential precautionary needs, which are derived from the purchasing power analysis of the regions”. However, it “does not aim to replace a ‘well-founded individual case analysis’,” write the authors.

Günther Laubis, SWR, tagesschau, January 4th, 2024 5:28 p.m