The boom in artificial intelligence has pushed the market value of chip manufacturer Nvidia over the three trillion dollar mark. It is only the third company to break this mark.

The US microchip manufacturer Nvidia has become the third company ever to break the three trillion dollar mark on the stock market. The chip manufacturer's shares closed on Wednesday evening (local time) on the New York Stock Exchange with a clear gain, which catapulted the company's market value upwards.

On Wednesday, Nvidia's share price continued its record-breaking run of the past weeks and months. With yesterday's increase of almost 5.2 percent to $1,224.40, the stock was once again one of the biggest winners in the Nasdaq 100. After hours, the stock continued to rise slightly. Based on the closing price, the market value was $3.01 trillion, just above that of Apple. Microsoft leads the rankings with $3.15 trillion.

Price increase of more than 700 percent

Apart from Nvidia, only Apple and Microsoft have managed to break the three trillion mark so far. Nvidia is a special case in that this increase in market value was achieved extremely quickly: Since the end of 2022, Nvidia's share price has increased by more than 700 percent; Apple increased by 50 percent in the same period. Microsoft's market value rose by almost 80 percent during this time, about as much as the Nasdaq 100.

Since the beginning of the year alone, Nvidia shares have increased in value by almost two and a half times. Apple shares, on the other hand, have gained less than two percent.

Nvidia plans stock split of one to ten

But the huge jumps in the price of Nvidia shares also mean that the stock, at more than $1,000, is simply too expensive for many investors. That is why the chip specialist has announced a stock split for tomorrow, Friday. Anyone who currently holds an Nvidia share will receive ten shares in return.

Otherwise, nothing will change for investors who already hold a share. However, the stock split at a ratio of one to ten will also reduce the price of the individual share to a tenth. As of tomorrow, a share will only cost around 122 dollars. This also means that profits and dividends will be distributed across ten times as many shares in the future.

According to experts, this stock split has consequences for the company in particular. Because it makes the shares cheaper for investors by reducing the price, Christian Andres, Professor of Finance at the Otto Beisheim School of Management, told Handelsblatt: “Companies maximize their liquidity on the market when their shares are traded more frequently, and that is the case when the price appears to be more favorable.”

Market leader in the AI business

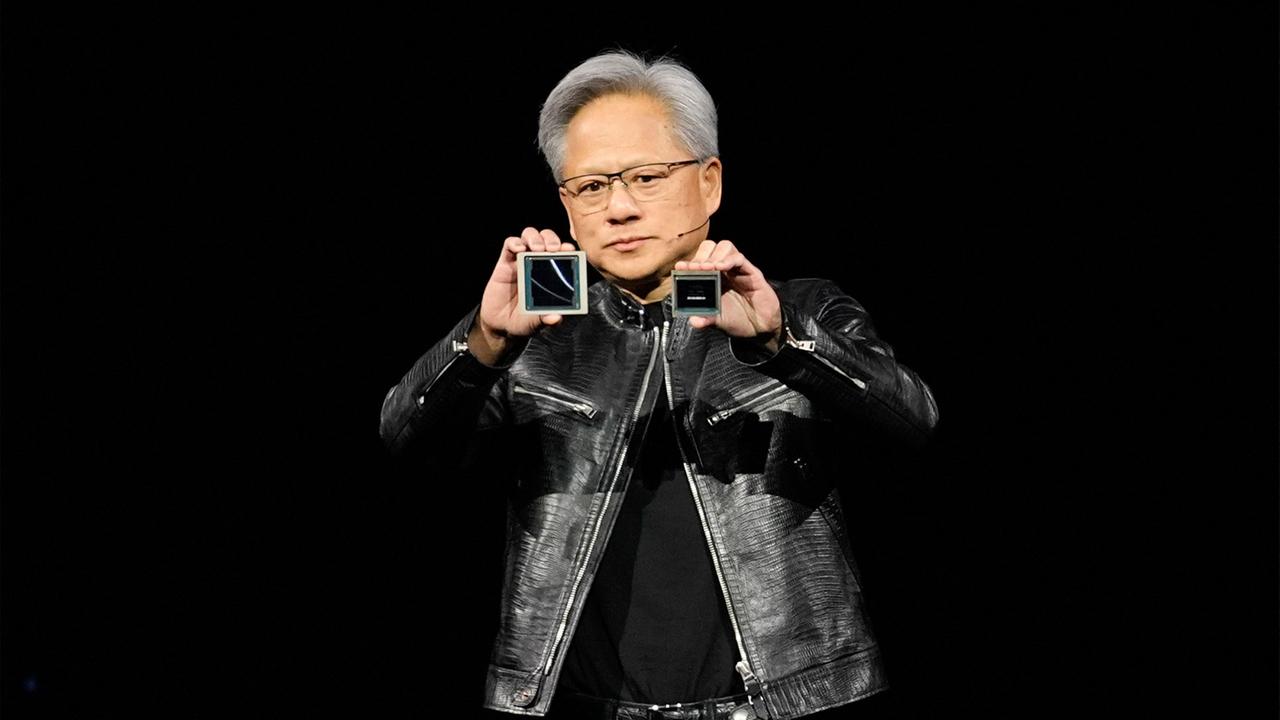

The reason for Nvidia's success: The company is the undisputed market leader in chips for artificial intelligence. The company's semiconductors play a key role in training AI software in data centers. Nvidia sells thousands of chip systems to Microsoft, Google and the Facebook group Meta, among others. At the beginning of the week, Nvidia boss Jensen Huang also announced a new platform for AI data centers called Rubin for 2026 at the Computex computer trade fair in Taiwan, which was well received by investors.

Nvidia is also active in the business of so-called digital twins, which companies can use to optimize processes in their factories using virtual copies. Finally, the company sells computers for automated and self-driving cars. Rivals such as Intel and AMD are also trying to participate in the AI boom, but have so far been unable to threaten Nvidia's leading position.

All of this is causing Nvidia's sales and profits – and thus its share price – to skyrocket. In the last quarter alone, sales rose from $7.2 billion in the previous year to $26 billion – an increase of 262 percent. And demand remains strong: bottlenecks are looming for Nvidia's new chip systems well into next year.

Founder is one of the richest people in the world

Co-founder and CEO Jen-Hsun Huang is also benefiting from this. Thanks to the current rally in Nvidia shares, he has become one of the richest people in the world. According to calculations by the Bloomberg news agency, he holds 3.5 percent of the shares. Bloomberg therefore currently estimates his wealth at 107 billion euros – a large part of which is due to the current Nvidia share package.

He is currently in 13th place in the Bloomberg table of billionaires. At the top is a European, Bernard Arnault, with a fortune of 210 billion dollars. He is the head and major shareholder of the French luxury goods group LVMH.