Welcome to our guide on joint tenants vs tenants in common in Canada. Buying a property is a significant investment, and it’s crucial to understand the different forms of ownership available to you under Canadian law.

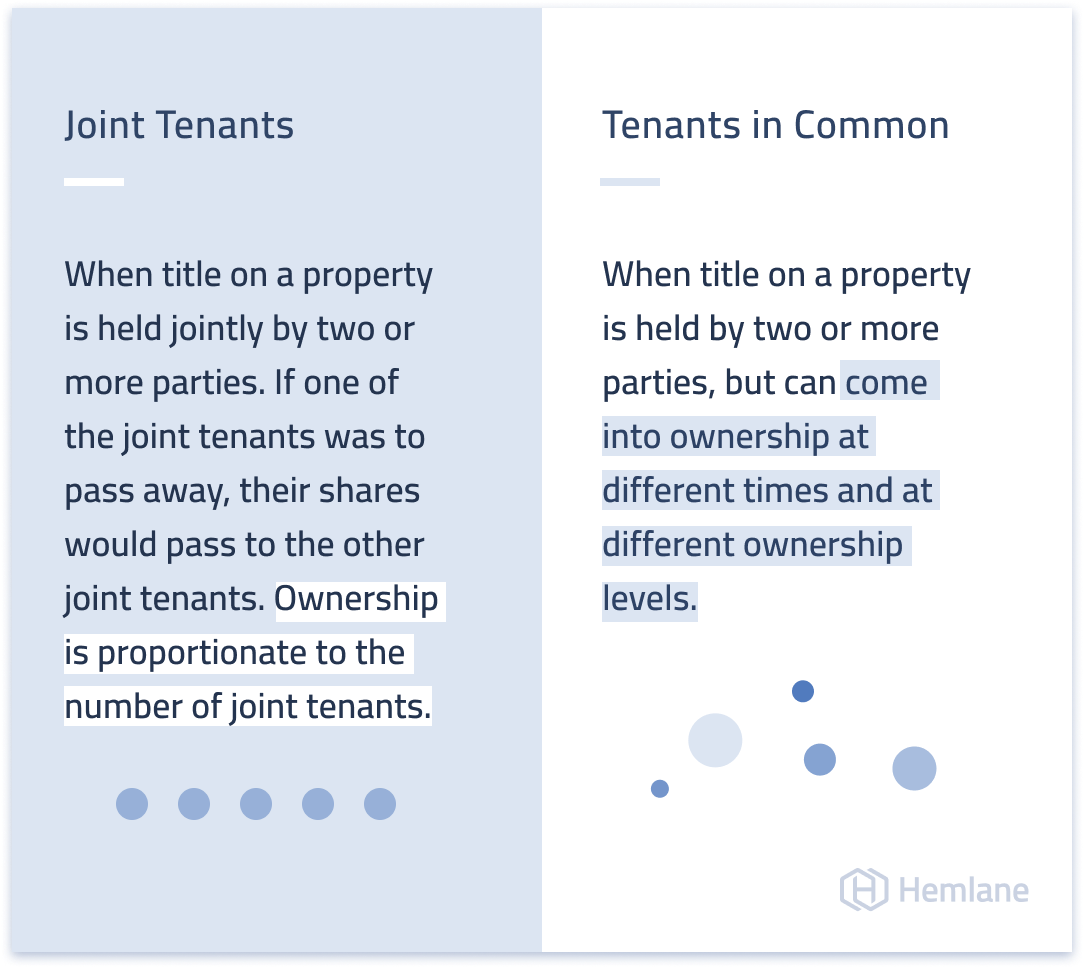

Co-ownership of real estate can take two forms: joint tenancy and tenancy in common. While both options allow multiple parties to own a property, they have distinct characteristics and implications for property division, inheritance, and spousal rights.

It’s important to have a firm grasp of the differences between joint tenancy and tenancy in common before making a decision. This guide will provide an overview of each type of ownership, highlight their benefits, and outline legal considerations to help you make an informed choice.

Read on to explore the nuances of joint tenants vs tenants in common Canada and ensure you choose the ownership structure that best suits your needs.

Understanding Joint Tenants and Tenants in Common

When it comes to co-owning real estate in Canada, there are two main options: joint tenancy and tenancy in common. Understanding the differences between these two forms of ownership is essential for making informed decisions about property ownership.

Joint Tenancy

Joint tenancy is a form of co-ownership where each owner has an equal share of the property. One of the key characteristics of joint tenancy is the concept of survivorship. If one owner passes away, their share of the property is automatically transferred to the surviving joint tenants, regardless of any instructions in their will. This means that the last surviving joint tenant becomes the sole owner of the property.

Spousal rights are also relevant to joint tenancy. If the co-owners are married or in a common-law relationship, the surviving spouse will typically inherit the deceased spouse’s share of the property through survivorship.

Tenants in Common

Tenancy in common, on the other hand, allows for co-owners to have distinct and separate shares of the property. Each owner is free to transfer or sell their share without the consent of the other co-owners. In case of death, the deceased’s share of the property is distributed according to their will (or the laws of intestate succession if there is no will).

This greater flexibility of tenancy in common can be particularly useful in situations where co-owners have different financial or family circumstances.

Understanding the differences between joint tenancy and tenancy in common is crucial for making informed decisions about property ownership in Canada. The next sections will explore the ownership rights of each type of co-ownership, the benefits and drawbacks of each, and considerations for married or common-law partners.

Ownership Rights of Joint Tenants

Joint tenancy is a popular form of property ownership in Canada, particularly for married or common-law partners. As joint tenants, each co-owner holds an equal share of the property with the right of survivorship. This means that when one joint tenant dies, their share automatically passes to the surviving joint tenants without the need for probate.

Survivorship is a crucial aspect of joint tenancy, allowing for a seamless transfer of ownership and avoiding the potential delays and costs associated with probate. It also ensures that the property remains in the hands of the surviving joint tenants, rather than being subject to the deceased owner’s will or estate.

Spousal rights are another key consideration when it comes to joint tenancy. In Canada, joint tenancy is often used as a means of providing for a surviving spouse or partner. If one joint tenant dies, their interest in the property passes to the surviving joint tenants, regardless of what the deceased tenant’s will may say. This means that a surviving spouse or partner is automatically entitled to the deceased tenant’s share of the property, without having to go through the probate process or contest a will.

Spousal Rights and Joint Tenancy

It’s important to note, however, that joint tenancy is not a foolproof means of providing for a surviving spouse or partner. If the other joint tenants pass away prior to the surviving spouse or partner, the property may not necessarily pass to them. Additionally, if the surviving spouse or partner is not a joint tenant, they may not be entitled to any portion of the property, even if they were in a common-law relationship with the deceased owner.

When considering joint tenancy, it’s essential to take into account the specific circumstances of the individuals involved and seek legal advice if necessary. A lawyer or real estate professional can provide guidance on the potential implications for spousal rights and inheritance, as well as help ensure that the joint tenancy agreement is structured appropriately.

Ownership Rights of Tenants in Common

Unlike joint tenancy, tenants in common co-owners have a distinct and separate share of the property. To put it simply, each co-owner owns a specified percentage of the property.

For example, let’s say two people, John and Jane, purchase a condo together as tenants in common. John puts in 60% of the down payment and Jane puts in 40%. They agree to split the mortgage payments equally. Therefore, John would own 60% of the condo, and Jane would own 40%.

Additionally, tenants in common have the right to sell or transfer their share of the property without the consent of other co-owners. This means that if John wanted to sell his 60% share, he could do so without Jane’s permission. However, keep in mind that selling or transferring their share may trigger the right of the remaining co-owners to purchase the departing co-owner’s share.

In the case of death, a tenant in common’s share is passed on to their heirs, as opposed to automatically transferring to the remaining co-owners like in joint tenancy. This can lead to more complicated property division if the heirs are unable to agree on what to do with the inherited share.

It’s important to note that tenants in common can still own property with their spouse or partner, but each partner’s share will be separate and distinct. This means that if one spouse passes away, their share can be passed on to whoever they designated in their will.

Differences in Property Division

When it comes to property division, joint tenancy and tenancy in common have distinct differences that are important to understand. In joint tenancy, the property is owned equally by all the co-owners, and in the event of a co-owner’s death, their share is automatically transferred to the surviving joint tenants. This process is known as survivorship.

On the other hand, tenants in common each own a specific share of the property, which can be sold or transferred without the consent of other co-owners. In the case of a tenant in common’s death, their share will be passed on to their chosen beneficiaries or heirs. This means that there is no automatic transfer of ownership to the remaining tenants in common.

It is important to note that Canadian law recognizes both forms of property ownership, and it is up to the co-owners to determine which option is best for them. However, it is crucial to seek legal advice to ensure that the property is divided appropriately and to avoid any potential disputes or legal issues in the future.

Benefits of Joint Tenancy

Joint tenancy offers a range of benefits that can make it an attractive option for co-ownership of real estate in Canada.

| Advantages of Joint Tenancy |

|---|

| Survivorship |

| Avoiding Probate: When one joint tenant passes away, their interest in the property is automatically transferred to the surviving joint tenants. This means that upon the death of a joint tenant, the property can transfer to the surviving co-owners without going through probate. This can save a significant amount of time and money in legal fees, making joint tenancy a more cost-effective option for estate planning. |

| Smooth Transfer of Ownership: The automatic transfer of ownership in joint tenancy can also make the process of inheriting the property more straightforward and hassle-free. It eliminates the need for legal documentation and procedures that can be time-consuming and stressful for the heirs. |

| Tax Benefits |

| Tax Planning: Joint tenancy can also have tax benefits for co-owners. When one joint tenant passes away and their interest in the property is transferred to the surviving co-owners, there is no capital gains tax triggered on the transfer. This can save significant amounts in taxes compared to other forms of property ownership. |

With the advantages of survivorship and tax planning, joint tenancy can be a smart and practical choice for co-ownership of real estate in Canada.

Benefits of Tenants in Common

In contrast to joint tenancy, tenants in common ownership offers several benefits that may suit certain individuals or groups more effectively.

- Greater Property Control: Tenants in common have greater control over their individual share of the property, which can be sold or transferred without the agreement of other co-owners. This is particularly advantageous for those who wish to have more autonomy in managing their property.

- Flexible Inheritance: When a tenant in common dies, their share of the property can be transferred according to their will or estate plan. This can be beneficial for those who want to have more control over who inherits their share of the property and how it is used after their death.

“Tenants in common ownership offers greater control and flexibility over individual shares of the property.”

Another important benefit of tenants in common ownership is that it is more suitable for non-married or non-romantic partners who want to co-own a property together. Under joint tenancy, the right of survivorship can leave the surviving partner with full ownership of the property, potentially disadvantaging the other co-owner(s). Tenants in common provides a fairer and more equitable way of managing property ownership for non-romantic partnerships or groups.

Ultimately, the decision between joint tenancy and tenants in common depends on individual circumstances, goals, and preferences. Seeking professional advice and doing thorough research are essential to making the best choice for you.

Considerations for Married or Common-Law Partners

When it comes to choosing between joint tenancy and tenancy in common, married or common-law partners need to consider their specific circumstances and the implications for their spousal rights and inheritance. While joint tenancy may offer certain advantages in terms of survivorship and avoiding probate, it may not be the best choice for all couples.

One important consideration is the potential impact on inheritance. In joint tenancy, the surviving co-owner(s) automatically inherit the deceased co-owner’s interest in the property, regardless of what is outlined in a will. This can result in unintended consequences, such as leaving out children from a previous marriage.

Additionally, joint tenancy may not provide adequate protection in case of divorce or separation. If one partner decides to end the relationship, they have the right to sever the joint tenancy and sell their share of the property, potentially leaving the other partner in a precarious position.

Therefore, tenants in common may be a better option for those who want more control over their individual share of the property, as well as greater flexibility in terms of inheritance and transfer of ownership. Each co-owner has a distinct and separate share of the property, which can be freely transferred or inherited as outlined in their will.

Ultimately, the choice between joint tenancy and tenancy in common should be based on individual circumstances and long-term financial goals. It is important for couples to have open communication and seek expert advice from real estate professionals and legal advisors before making a decision.

Implications for Inheritance and Estate Planning

Choosing between joint tenancy and tenancy in common can have significant implications for inheritance and estate planning. It is important to carefully consider your individual circumstances and long-term financial goals before making a decision.

For example, joint tenancy may be a suitable option for those who wish to avoid probate and ensure a smooth transfer of ownership to the surviving joint tenants. This can be especially beneficial for elderly individuals or those with serious health conditions. However, it is important to note that joint tenancy may not be the best choice for those with complicated family dynamics or complex financial situations.

On the other hand, tenants in common may be a more appropriate choice for those who value greater control and flexibility over their share of the property. With tenants in common, each co-owner has a distinct and separate share of the property, which can be freely transferred or inherited. This can be useful for those who wish to leave their share of the property to specific family members or beneficiaries.

Regardless of your choice, it is recommended that you seek legal advice and consult with real estate professionals to ensure that your property ownership aligns with your long-term financial goals and provides adequate protection for you and your loved ones in the event of death or other unforeseen circumstances.

Legal Considerations and Expert Advice

Choosing between joint tenancy and tenancy in common in Canada can be a complex decision, with many legal considerations that must be taken into account. It is important to seek expert advice and consult with a real estate professional to ensure that you fully understand your options and the potential implications of each choice. Here are some key legal considerations and expert advice to keep in mind:

| Legal Considerations | Expert Advice |

|---|---|

|

Spousal Rights: Joint tenancy can offer greater protection to married or common-law partners in the event of death, as their interest in the property will automatically pass on to the surviving joint tenant. However, tenants in common may be a better option if you have children from a previous relationship or if you want to ensure that your share of the property is passed on to specific beneficiaries. |

Consult with a lawyer to understand the legal implications of spousal rights and how they apply to your individual circumstances. |

|

Inheritance: The way that property is divided between joint tenants and tenants in common can impact inheritance planning. Joint tenancy offers survivorship rights, but tenants in common may be a better option if you want to ensure that your share of the property goes to specific beneficiaries. |

Speak with a financial advisor or estate planner to understand how your choice of co-ownership will impact your individual estate planning goals. |

|

Property Control: Tenants in common have greater control and flexibility over their share of the property, as they can sell or transfer their interest without the consent of other co-owners. However, this can also lead to disputes or complications if there are disagreements between co-owners. |

Discuss property control issues with your co-owners to ensure that everyone is clear on the expectations and responsibilities of each individual. |

Remember, the choice between joint tenancy and tenants in common will depend on your unique needs and circumstances. Take the time to research and reflect on your options, and don’t hesitate to seek expert advice when necessary.

Making the Best Choice for You

Choosing between joint tenancy and tenancy in common can be a difficult decision, but ultimately, it comes down to your individual needs and circumstances. Consider the following factors when making your choice:

- How many co-owners will there be?

- What are their relationships to you?

- How do you intend to use the property?

- What are your long-term financial goals?

- What are the potential tax implications?

It’s important to discuss these questions openly with your co-owners or potential co-owners. Take the time to research and understand the differences between joint tenancy and tenancy in common to make an informed decision. Don’t hesitate to seek professional advice if you’re unsure.

Remember: the choice you make will affect how your property is owned and controlled, so it’s crucial to choose an option that aligns with your preferences and future plans.

Conclusion

Choosing between joint tenancy and tenancy in common ownership is a crucial decision that requires careful consideration. As we’ve discussed, there are distinct differences between the two, including property division, inheritance, and spousal rights. It’s important to understand the implications of each option, and to seek professional advice when necessary.

Ultimately, the choice between joint tenancy and tenancy in common will depend on individual circumstances, family dynamics, and long-term financial goals. Both options have their advantages and disadvantages, and it’s vital to weigh them carefully before making a decision.

We hope this article has provided a helpful overview of joint tenancy vs tenancy in common in Canada. By understanding the differences and seeking expert guidance, you can make an informed decision about property ownership that best suits your needs and preferences.