analysis

On this “black Monday”, many investors are nerves bare. What else can you do? Experts put the investment horizon and the investment strategy in the foreground.

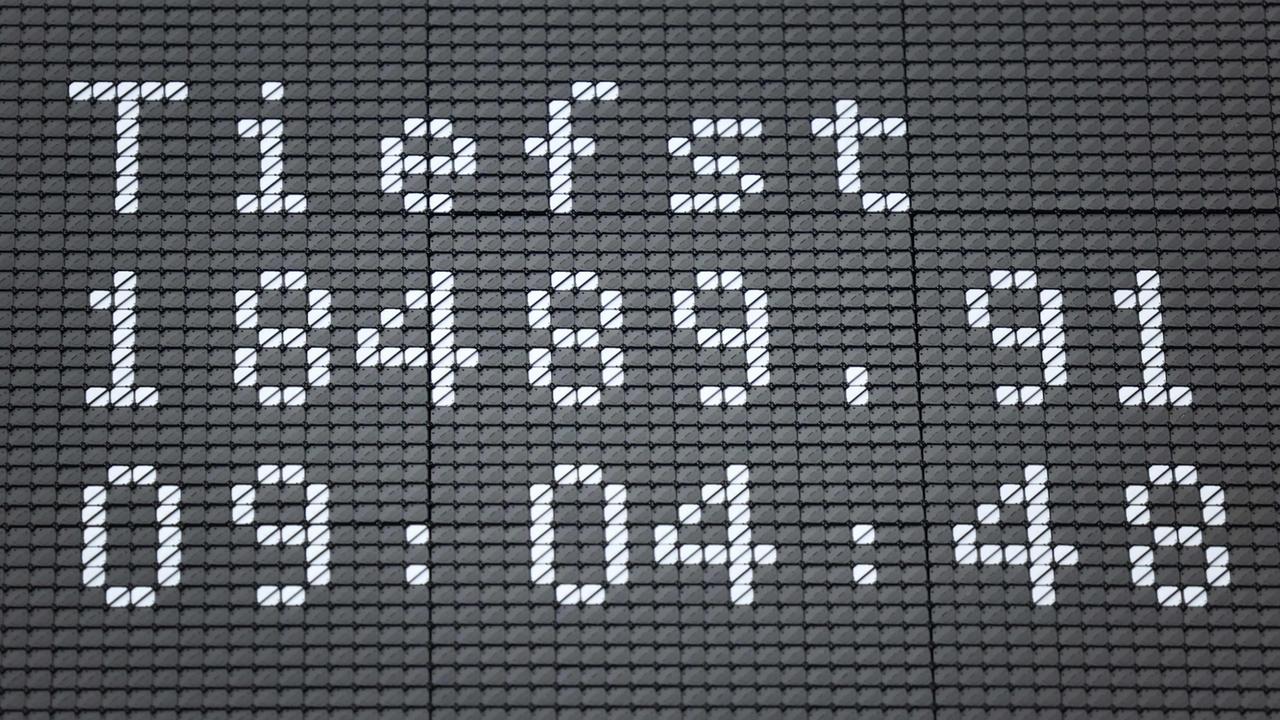

Anyone who speaks of “Panic” or “Crash” on the stock exchanges these days do not exaggerate: triggered by the aggressive customs policy of the USA and the hard response from China, the DAX has cycled its profits of spring in just three days and is currently listing at the level of last November. As bitter as a view of your own depot may be: “Panic” is not a good advisor for investors, the stock market professionals emphasize.

It depends on the timeline

But what else can investors do in this situation? “It just depends on the investment horizon,” emphasizes Jürgen Molnar, capital market expert from the online broker Robomarkets and arranges the action in terms of time: “The DAX has almost doubled in two and a half years. This year it has already won 18 percent.

However, this offers opportunities for investors oriented in the medium and long term. “Now we have normal conditions again, and you are currently receiving quality shares for a good discount,” said the stock exchange expert. In the shorter period, of course, a lot of Donald Trump's angle trains depend: “If he winds again like an eel and says that everything was not meant so, it can quickly go up again.”

On Diversification regard

Of course, the stock market professionals cannot foresee what exactly in the customs dispute and the markets will happen in the customs dispute and at the markets. Christian Röhl from Scalable Capital therefore emphasizes the importance of broad diversification in asset structure. “We don't know how this situation goes out and who are possible winners and losers,” said the investment expert over the ARD finance editor. If the situation has calmed down again, investors should wonder how they personally deal with the stress and whether their systems are sufficiently diversified.

“For all those who see asset structure as a marathon, this is now only a dry spell on the first meters,” said Röhl. For a worldwide diversification, products on the world index MSCI ACWI, which also includes the markets of the emerging countries. Gold is considered anchor, but can also come under pressure in such phases if investors needed liquidity – as has already been observed.

Get in in government bonds?

Many experts bring bonds into play as long -spurned investment alternatives. The US assets administrator PGIM pleads to look at “from EU peripherals” such as Italy, Spain, Portugal or Greece in view of the recently increased return on government bonds. The “concerns about the load -bearing capacity of the debts” are ultimately exaggerated.

Anyone who is currently single as a result of the crash in the course will initially be able to do little with such investment recommendations. However, investors should use the bitter experience of how brutal stock exchange can sometimes be to worry about a longer -term sustainable investment strategy.

In addition to the strategy, the time horizon remains decisive – it is reminiscent of the legendary advice of Börsenguru André Kostolany: “Buy stocks, take sleeping pills and no longer look at the papers. After many years you will see: you are rich.”