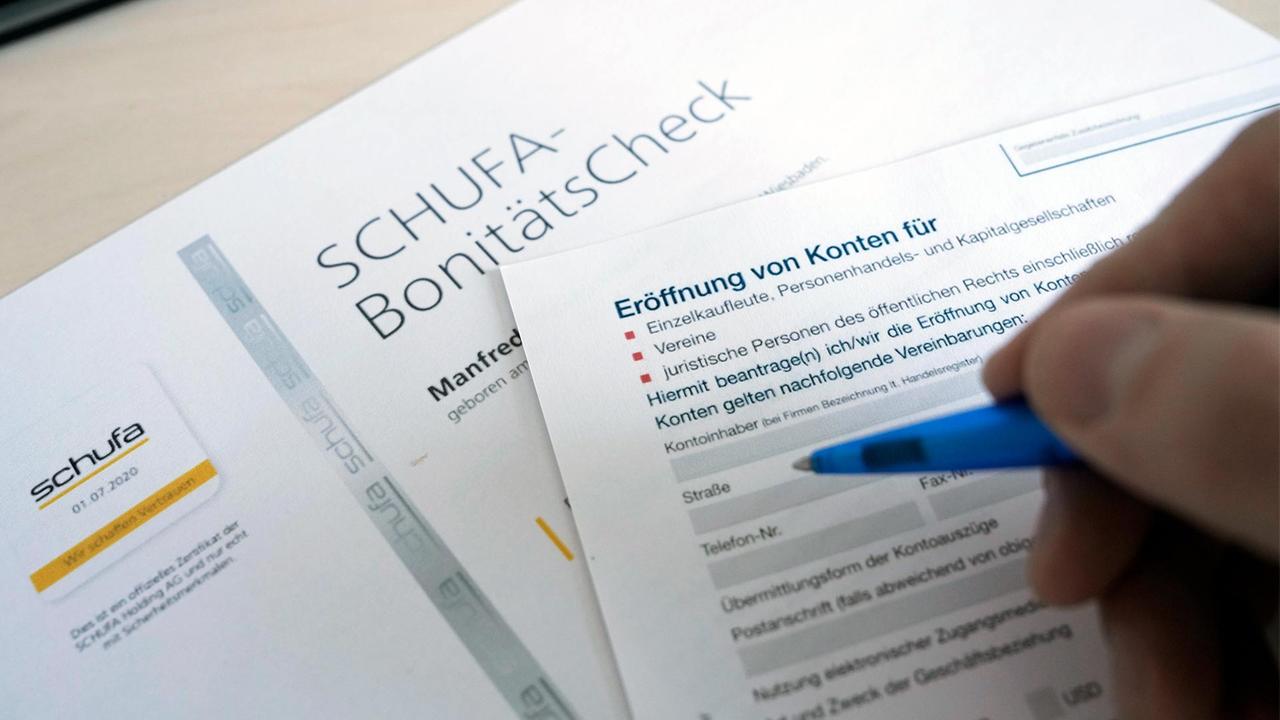

Credit agencies such as Schufa calculate the creditworthiness of consumers. However, there is no check of credit scores. From the point of view of consumer advocates, this should change.

Everything possible in Germany is transparently checked and certified. But there is no independent quality control when it comes to the sensitive consumer ratings from Schufa & Co., complain consumer advocates. And that is why they are taking today's first reading of the new Federal Data Protection Act (BDSG) as an opportunity to demand a kind of “Schufa TÜV”.

The so-called credit scores, which are calculated by credit agencies and which companies use to assess the creditworthiness of consumers, are to be certified in the future, much like cars are certified by a TÜV inspection.

Score should Payment behavior predict reliably

“Concrete quality requirements for the forecast accuracy and meaningfulness of the scores should be defined and checked within the framework of mandatory certification procedures,” says a statement by the German Consumer Organisation (vzbv), which ndr and Süddeutsche Zeitung.

On the one hand, this means that credit agencies should only use information that can be proven to say something about people's payment behavior when evaluating people. In addition, credit agencies should also have to prove that their score can actually reliably predict people's payment behavior.

Credit rating calculation should become more transparent

A second important demand from consumer advocates is aimed at companies that query credit scores from credit agencies and use them to make decisions about a loan or contract. They should be required to inform consumers if a contract for a cell phone or a loan is not approved because of a bad Schufa score. Up until now, those affected had little insight into such cases and could only guess what role their score played in the case of rejection by mobile phone operators or banks.

The “use and calculation of credit scores is often hidden from consumers,” says the vzbv. The association therefore proposes that the law should stipulate that people should be informed precisely and transparently about their score and its significance for the contract decision in the future.

No longer rate consumers based on their neighborhoods

In their current government draft, the Federal Ministry of the Interior under the leadership of Nancy Faeser (SPD) and the Consumer Protection Ministry under Steffi Lemke (Greens) already want to set stricter rules for credit agencies such as Schufa in the future. This is their response to a ruling by the European Court of Justice (ECJ) in December 2023 that made changes necessary.

The most important change concerns the use of personal data. The draft law already states that credit agencies will no longer be allowed to rate consumers based on the area they live in. This step has long been called for by consumer and data protection advocates and has been welcomed accordingly.

However, ndr and SZ reports that the new regulation could also mean that the Schufa credit agency has even more power than before. The new Federal Data Protection Act is to be passed before the summer break. The time pressure is high, say parliamentary circles, also because there are still several requests for changes to the new law.